Skwad Widgets for iPhone and Mac: Your Finances at a Glance

Oct 30, 2025

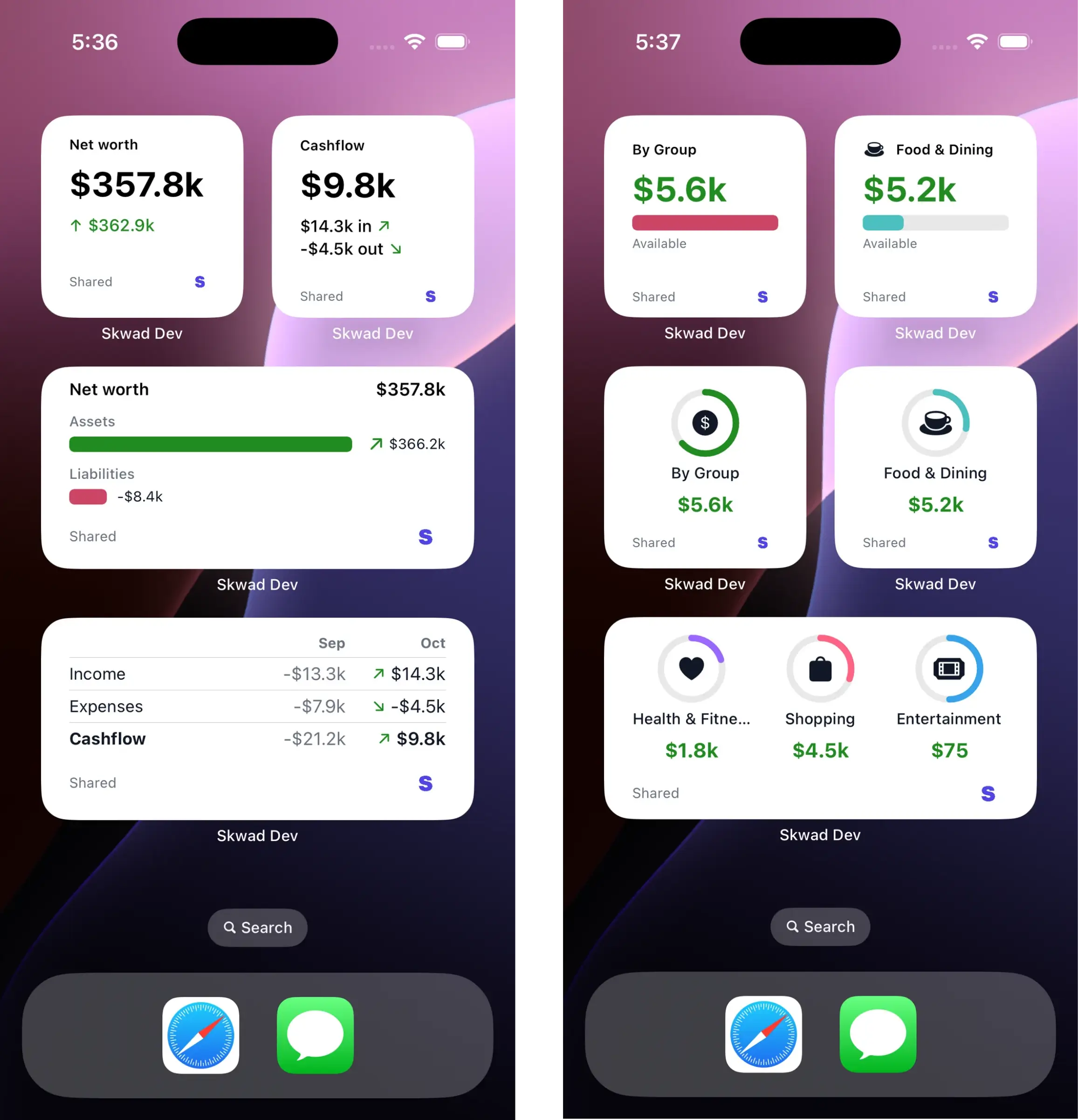

Your financial life shouldn't require opening an app every time you want a quick update. That's why we're excited to introduce Skwad widgets for iPhone and Mac, bringing your most important financial information directly to your home screen, lock screen, and desktop. With a quick glance, you can check your budget status, review account balances, or see recent transactions without interrupting whatever else you're doing.

Widgets represent a fundamental shift in how you interact with your finances. Instead of financial management being something you actively do at specific times, it becomes ambient information that's always present, always informing your decisions. That coffee purchase might feel different when your daily spending widget shows you're already at 80% of your dining budget.

What Are Skwad Widgets?

Widgets are miniature displays that show real-time information from Skwad directly on your device's home screen, lock screen, or Mac desktop. They update automatically throughout the day, ensuring you always see current data without manually refreshing.

Think of widgets as windows into your financial dashboard. You choose what information to display, how large to make each widget, and where to place them on your screen. The widgets pull live data from your Skwad account, so changes you make in the app immediately reflect on your widgets.

Unlike notifications that interrupt you with alerts, widgets provide passive information. They're there when you want them, invisible when you don't look. This non-intrusive approach to financial awareness has helped many users develop healthier relationships with their money.

Widget Types and Sizes

The Skwad widget collection offers several information displays, each available in multiple sizes to fit your home screen layout.

Budget Widget

The budget widget is our most popular, displaying your spending progress for one or more budget categories. At a glance, see how much you've spent versus how much you budgeted, with visual progress bars that make status immediately clear.

Small size: Shows a single category with spent amount and remaining balance. Perfect for tracking your most important budget category, whether that's dining out, groceries, or discretionary spending.

Medium size: Displays multiple categories in a compact grid. See your top three or four categories simultaneously, quickly identifying any that need attention.

Large size: Comprehensive budget overview showing all your active categories with detailed progress bars. Ideal if you want complete visibility without opening the app.

The budget widget color-codes categories based on status. Green indicates healthy spending on track. Yellow warns you're approaching your limit. Red signals you've exceeded the budget. These visual cues make it effortless to assess your financial status in a split second.

Account Balance Widget

The account balance widget shows current balances for your connected accounts. Whether you want to track a single checking account or see your complete financial picture across multiple institutions, this widget keeps the information accessible.

Small size: Single account balance display. Know exactly what's in your primary checking account whenever you unlock your phone.

Medium size: Multiple accounts with individual balances. Track checking, savings, and credit card balances together.

Large size: Full account summary including total assets, total liabilities, and net position. Great for users who want complete financial visibility at all times.

Balance data updates automatically as transactions post to your accounts. If you're using Plaid integration, balances typically refresh multiple times daily. For accounts using email scanning, balances update as you receive and forward bank alerts.

Recent Transactions Widget

Stay aware of account activity with the recent transactions widget. This display shows your latest transactions, helping you spot unexpected charges quickly and stay connected to your spending in real-time.

Small size: Shows your most recent transaction with amount and merchant. Quick verification that your latest purchase recorded correctly.

Medium size: Last three to five transactions with basic details. Catch any surprises early without digging through your full transaction list.

Large size: Extended transaction history with categories and full merchant names. A mini transaction feed right on your home screen.

This widget is particularly valuable for catching fraudulent charges quickly. When you see a transaction you don't recognize, you can investigate immediately rather than discovering it days later during your regular review.

Spending Summary Widget

The spending summary widget aggregates your spending over a selected time period, typically the current month or week. Unlike the budget widget which compares spending to planned amounts, the spending summary simply shows what you've spent.

This widget supports breakdown views showing spending by category, helping you understand where your money goes without opening reports. It's the quickest way to answer "how much have I spent this month?" or "what did I spend on food this week?"

Setting Up Widgets on iPhone

Adding Skwad widgets to your iPhone takes just a moment:

- Long-press on your home screen until the apps start jiggling

- Tap the plus button in the top corner

- Search for "Skwad" in the widget gallery

- Choose your widget type and size

- Tap "Add Widget" to place it on your screen

- Position the widget where you want it

- Tap "Done" to save your layout

After adding a widget, you may need to configure which specific data it displays. Long-press on the widget and select "Edit Widget" to choose categories, accounts, or other options depending on the widget type.

Lock Screen Widgets

iOS supports widgets on the lock screen, giving you financial information without even unlocking your device. Lock screen widgets are smaller and simpler than home screen widgets, showing key metrics like remaining budget or primary account balance.

To add a lock screen widget:

- Long-press on your lock screen

- Tap "Customize"

- Select the lock screen panel

- Tap the widget area below the time

- Add Skwad widgets from the gallery

- Tap "Done" when finished

Lock screen widgets update in real-time, so your financial status is literally the first thing you see when you pick up your phone.

Setting Up Widgets on Mac

Mac widgets appear in Notification Center and can be pinned to your desktop for always-visible financial information.

- Click the time in your menu bar to open Notification Center

- Scroll to the bottom and click "Edit Widgets"

- Find Skwad in the widget list

- Drag widgets to your Notification Center or desktop

- Configure each widget by right-clicking and selecting options

For desktop widgets, you can position them anywhere on your screen. Many users place financial widgets in a corner where they're visible but not distracting, providing constant awareness without interfering with work.

Desktop Widget Best Practices

When placing widgets on your Mac desktop:

- Consider visibility over commonly used windows

- Group related widgets together (all financial info in one area)

- Choose sizes appropriate for your screen resolution

- Remember widgets are visible to anyone who can see your screen

If privacy is a concern, Notification Center widgets may be preferable since they're hidden most of the time and only visible when you explicitly open them.

Widget Privacy Considerations

Financial information is sensitive, and displaying it on your device raises legitimate privacy questions. We've thought carefully about how to handle this.

What Widgets Display

Skwad widgets show summary information, not detailed transaction histories or full account numbers. You might see "Chase Checking: $2,341" but not your full account number or recent transaction details beyond basic merchant names.

When Others Might See Your Screen

Consider who might see your device throughout the day. In public spaces, home screen widgets are visible whenever you unlock your phone. Lock screen widgets are visible without any authentication. Desktop widgets are visible to anyone near your computer.

If this concerns you:

- Use Notification Center widgets instead of desktop widgets

- Avoid lock screen financial widgets

- Place home screen widgets on a secondary page

- Choose smaller widget sizes that show less detail

Secure Display Options

Some users create a "financial dashboard" home screen page that they only visit when alone. This keeps financial information accessible but not constantly visible. iOS widget stacks also help, allowing you to swipe through multiple widgets in the same space so financial data isn't always on top.

Optimizing Your Widget Layout

The best widget setup depends on your financial goals and what information helps you make better decisions.

For Budget-Focused Users

If staying within budget is your primary goal, prioritize budget widgets:

- Large budget widget showing all categories

- Small widget for your most problematic spending category

- Recent transactions widget to catch unplanned purchases

This layout keeps budget status front and center, reminding you of spending limits before you make purchases.

For Balance Watchers

If tracking account balances drives your financial behavior:

- Medium account balance widget showing primary accounts

- Small spending summary for context

- Recent transactions widget for activity awareness

This setup helps you maintain target balances and avoid overdrafts.

For Minimal Awareness

Some users prefer less information, avoiding the anxiety that constant financial monitoring can cause:

- Single small widget showing overall financial health

- No lock screen widgets

- Financial widgets on a secondary home screen page

This approach provides access to information when you want it while avoiding constant reminders.

Troubleshooting Widget Issues

Occasionally widgets may not display data correctly. Here are common issues and solutions.

Widget Shows "Unable to Load"

This usually means the widget can't communicate with Skwad's servers. Check your internet connection and try again. If the problem persists, removing and re-adding the widget often resolves the issue.

Data Seems Outdated

Widgets refresh automatically, but refresh frequency depends on iOS's background app refresh settings. Ensure Skwad has background refresh enabled in Settings > General > Background App Refresh.

Widget Disappeared After Update

App updates occasionally require widgets to be reconfigured. If your widgets disappear or stop working after updating Skwad, remove them from your home screen and add them again.

Can't Find Skwad in Widget Gallery

Make sure you're running the latest version of Skwad. Widgets require a recent app update. Check the App Store for updates if Skwad doesn't appear in your widget gallery.

The Psychology of Financial Widgets

There's real psychology behind why widgets help with financial management. Research on behavior change shows that environmental cues strongly influence our decisions. By placing financial information in your environment, you're essentially creating cues that nudge you toward better financial choices.

When you see your dining budget is nearly exhausted, you might reconsider that restaurant meal. When your recent transactions widget shows several subscription charges, you might remember to cancel that service you never use. When your balance widget shows your emergency fund growing, you feel motivated to continue saving.

This isn't about obsessing over money or creating anxiety around spending. It's about making financial information as readily available as other information you check throughout the day, like weather, messages, or calendar events. Your finances deserve that same visibility.

Beyond Widgets: The Skwad Ecosystem

Widgets are one part of Skwad's approach to making financial management effortless. They work alongside other features that reduce the friction of staying on top of your money.

Automated categorization means transactions arrive already organized. Rules and automations handle repetitive tasks without your intervention. Budget reviews provide structured reflection time. Cashflow reports deliver insights when you want deeper analysis.

Widgets complement these features by providing the awareness layer. They ensure you're never surprised by your financial status because that information is always visible, always current, always just a glance away.

Getting Started

If you're already a Skwad user, update your app to the latest version and widgets will be available in your device's widget gallery. New to Skwad? Sign up for a free trial and experience how widgets can transform your relationship with your finances.

Your financial health deserves more than occasional check-ins. With Skwad widgets, it gets the constant visibility that keeps you informed, motivated, and in control.

Get a better understanding of your finances today.

Start your 15-day trial

© 2026 TCS Digital, LLC.

Created and hosted in the USA 🇺🇸

Data encrypted & stored with AWS 🔒

Bootstrapped & funded by our users.

Resources

Skwad bookFree bank transaction categorizerHow to setup auto import without bank linkingBank linking with 11,000+ financial institutionsHow to auto sync transactions to Google SheetsHow to import old transactions