Protecting Your Financial Privacy: Automating Transactions Import Without Linking Your Bank

Apr 2, 2024

In the digital age, managing personal finances has become increasingly streamlined, with many applications promising to simplify budgeting, expense tracking, and financial planning. However, privacy and security concerns loom large amidst these platforms' convenience, particularly when linking bank accounts.

At Skwad, we give users multiple choices in how they connect to their finances. Our default approach never requires linking bank accounts, prioritizing the privacy and security of your financial information through our email scanning method. Explore why this approach matters and how it sets us apart in personal finance management.

The Risks of Bank Linking

Many financial apps today rely on users linking their bank accounts directly to the platform. While this may seem convenient, it comes with inherent risks. By providing your bank login credentials to third-party apps, you effectively grant them access to sensitive financial data, including account balances, transaction history, and even the ability to initiate transfers.

This practice raises significant security concerns. Every additional intermediary through which your bank credentials pass presents a potential vulnerability. Even with stringent security measures, the risk of data breaches or unauthorized access remains ever-present. Moreover, the more apps you link to your bank account, the greater the potential exposure of your sensitive information.

Skwad's Bank-Linking-Free Approach

Skwad offers a refreshing alternative: our email scanning approach eliminates the need for bank linking while prioritizing user privacy and security. Rather than requiring users to divulge their bank login credentials, we empower them to take control of their financial data while still enjoying the benefits of automated transaction import and expense tracking.

How to Set Up Automated Transaction Import

With Skwad, users can effortlessly import transactions without exposing their bank passwords. By leveraging their Skwad scan email address, users can set up spending alerts with their bank and designate their Skwad scan address as the recipient.

Here's how it works: whenever a transaction in your bank account meets the criteria specified in your spending alerts (such as a purchase exceeding a certain amount like $0.01), your bank will automatically send a notification to your email address. By forwarding this to your Skwad scan address, Skwad can process this notification and import the transaction details into your account, keeping your financial records up-to-date without bank linking.

Step 1: Get Your Skwad Scan Address

Sign up for Skwad to receive your personalized Skwad scan email address such as [email protected]. This is your dedicated inbox for syncing various financial notifications.

You can find your scan address in your Skwad Settings.

Step 2: Set Up Email Forwarding

Set up automatic forwarding from your personal email to your Skwad scan address. This works with Gmail, Outlook, iCloud Mail, Proton Mail, and other email providers.

- How to forward transactions from Gmail to Skwad

- How to forward transactions from Proton Mail to Skwad

- How to forward transactions from iCloud Mail to Skwad

- How to forward transactions from Outlook to Skwad

Setting Up Gmail Forwarding

Add Forwarding Address in Gmail

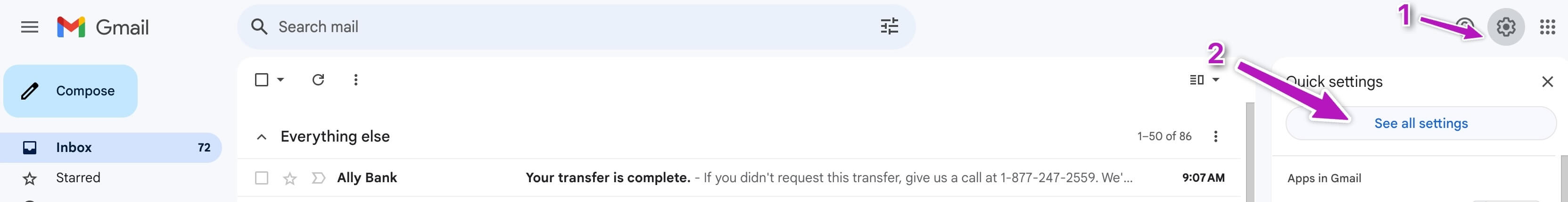

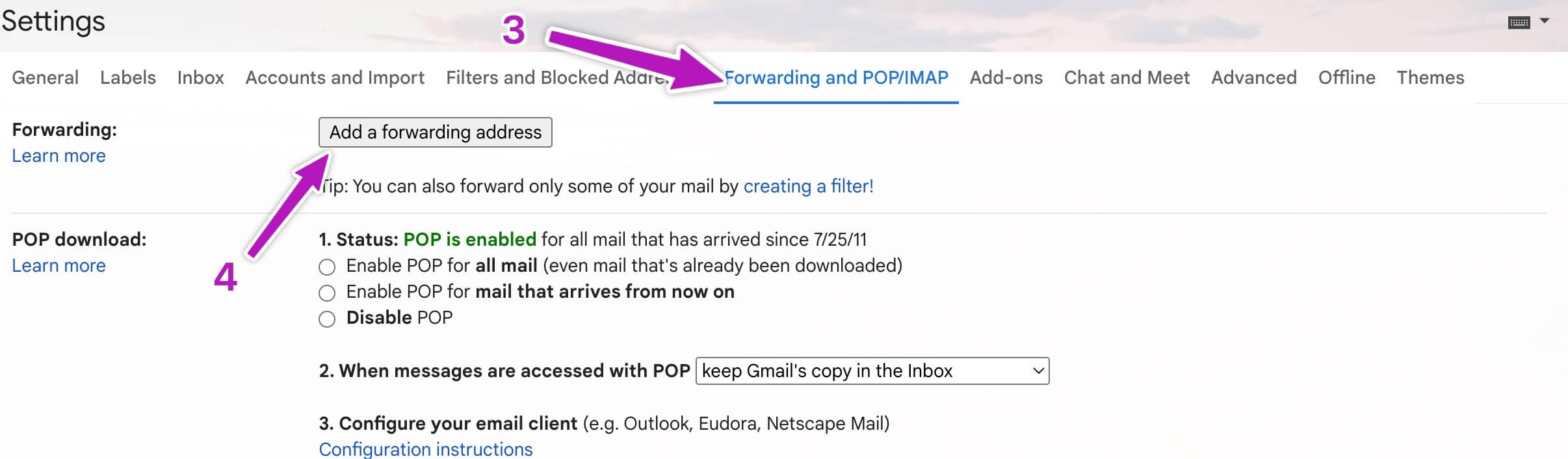

- Open Gmail and go to Settings > See all settings > Forwarding and POP/IMAP

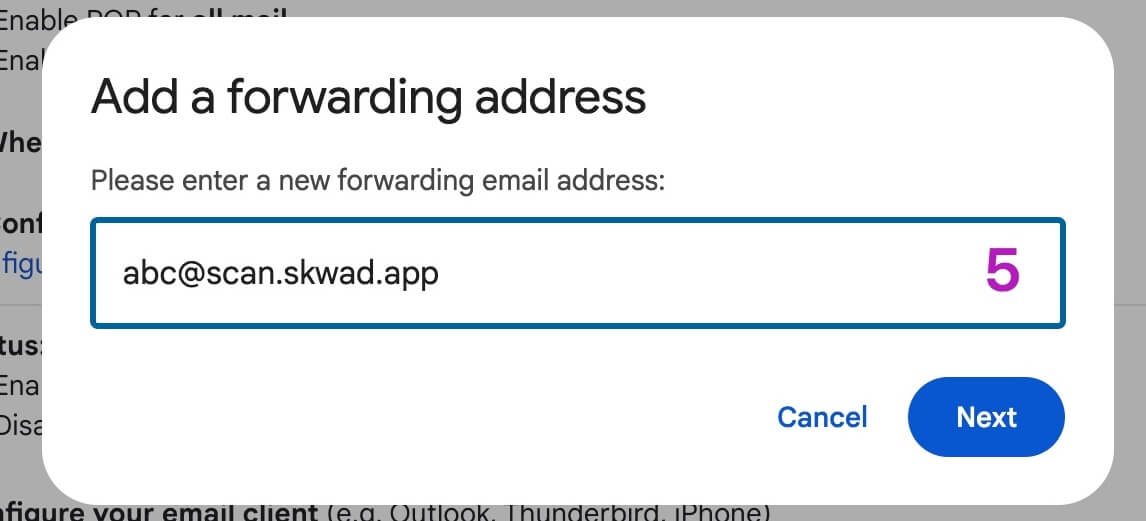

- Click Add a forwarding address and enter your Skwad scan address (e.g.,

[email protected])

Verify Your Forwarding Email

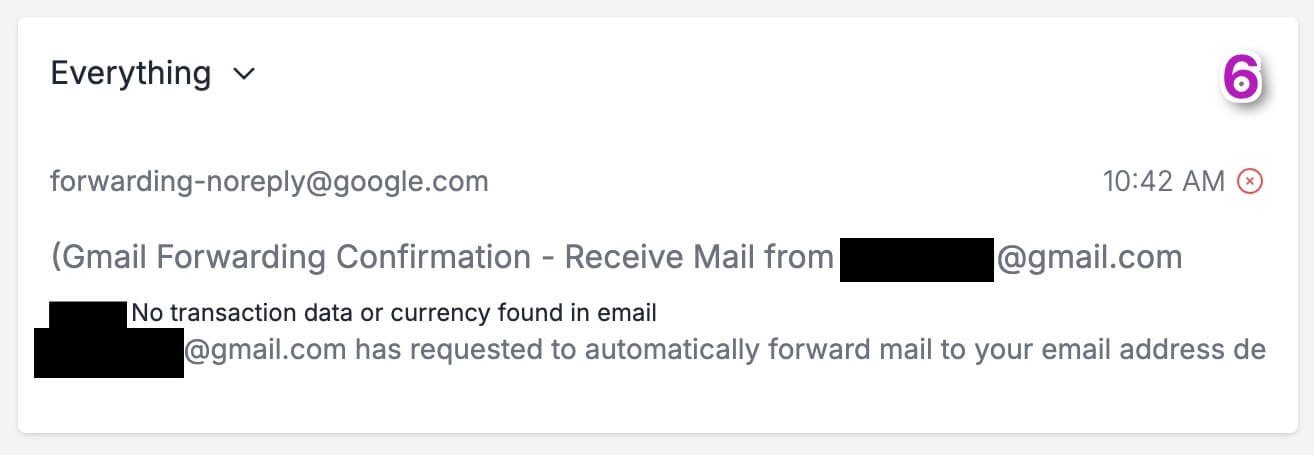

Google will send a verification link to your Skwad scan inbox. To verify:

- Go to Drawer > Inbox on desktop or More > Inbox on mobile in Skwad

- Click on the Gmail verification email to expand it

- Copy and paste the verification link in your browser

Create Forwarding Rules

Once verified, set up filters to automatically forward transaction emails:

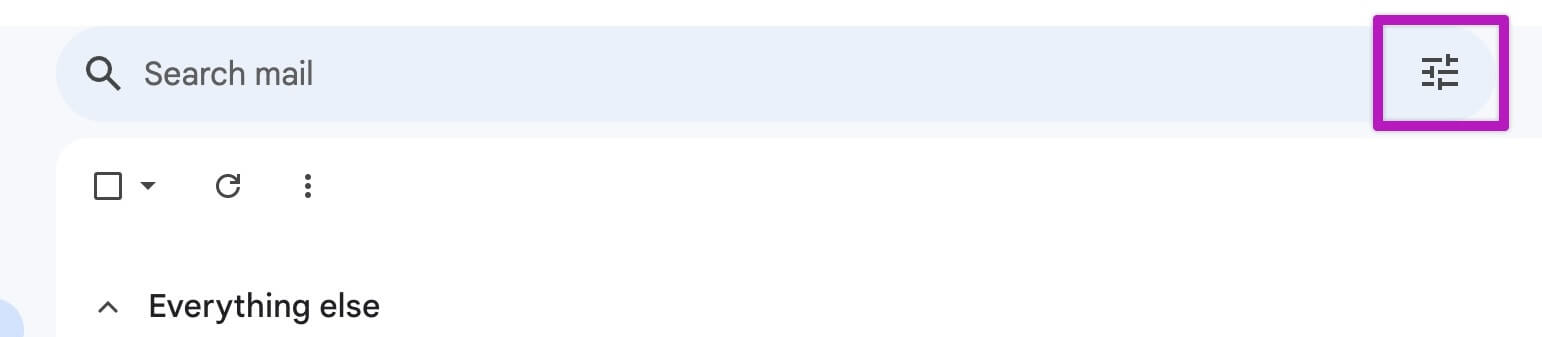

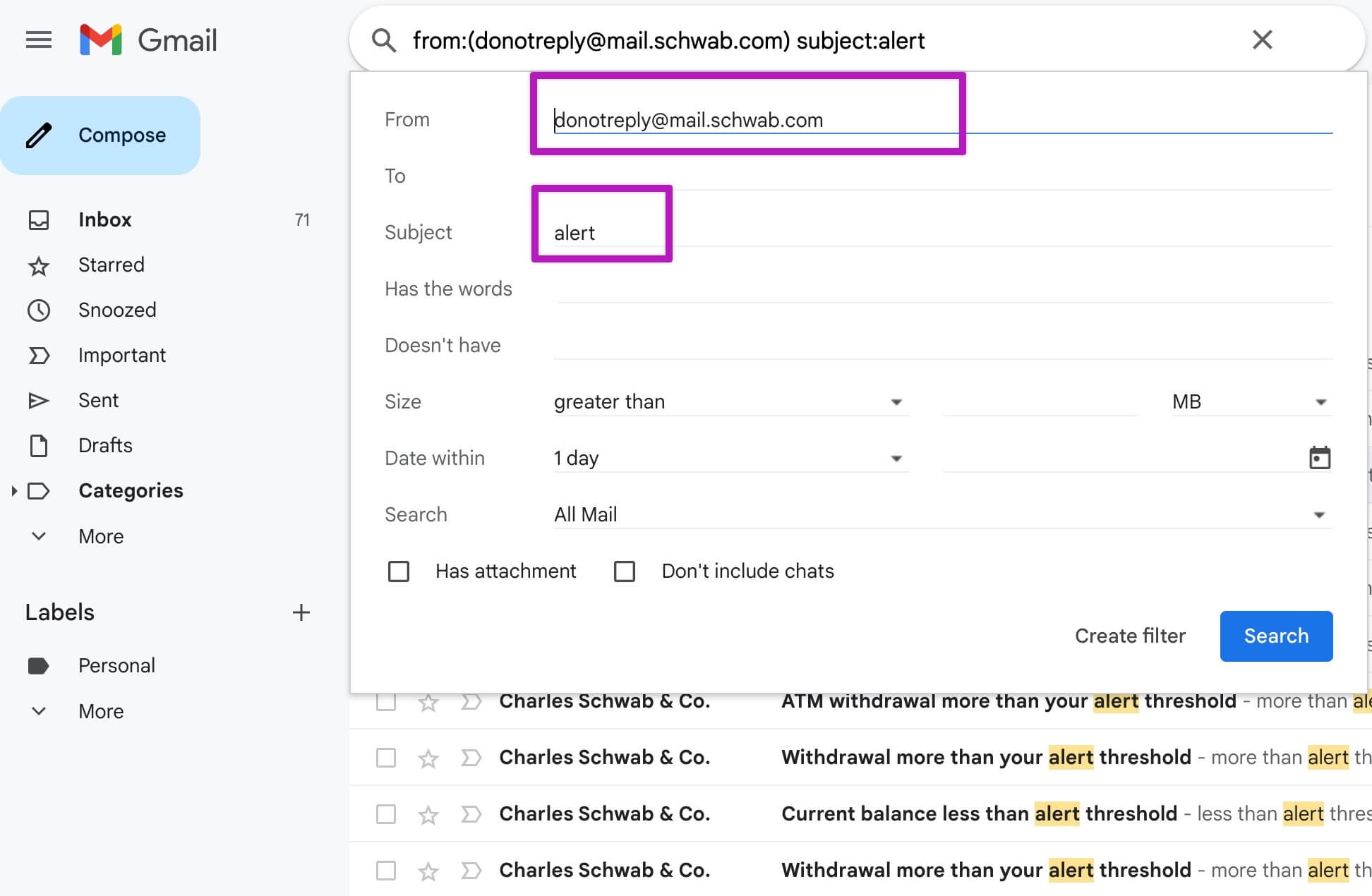

- In Gmail, click the filter icon in the search bar

- Create filters for each bank or card you want to track

Tip: You can create simple filters (1 per bank) or advanced ones that capture all your alerts. Click "Search" to verify what's being filtered.

Note: Skwad will automatically distinguish between transactions and balance updates. All you have to do is forward them.

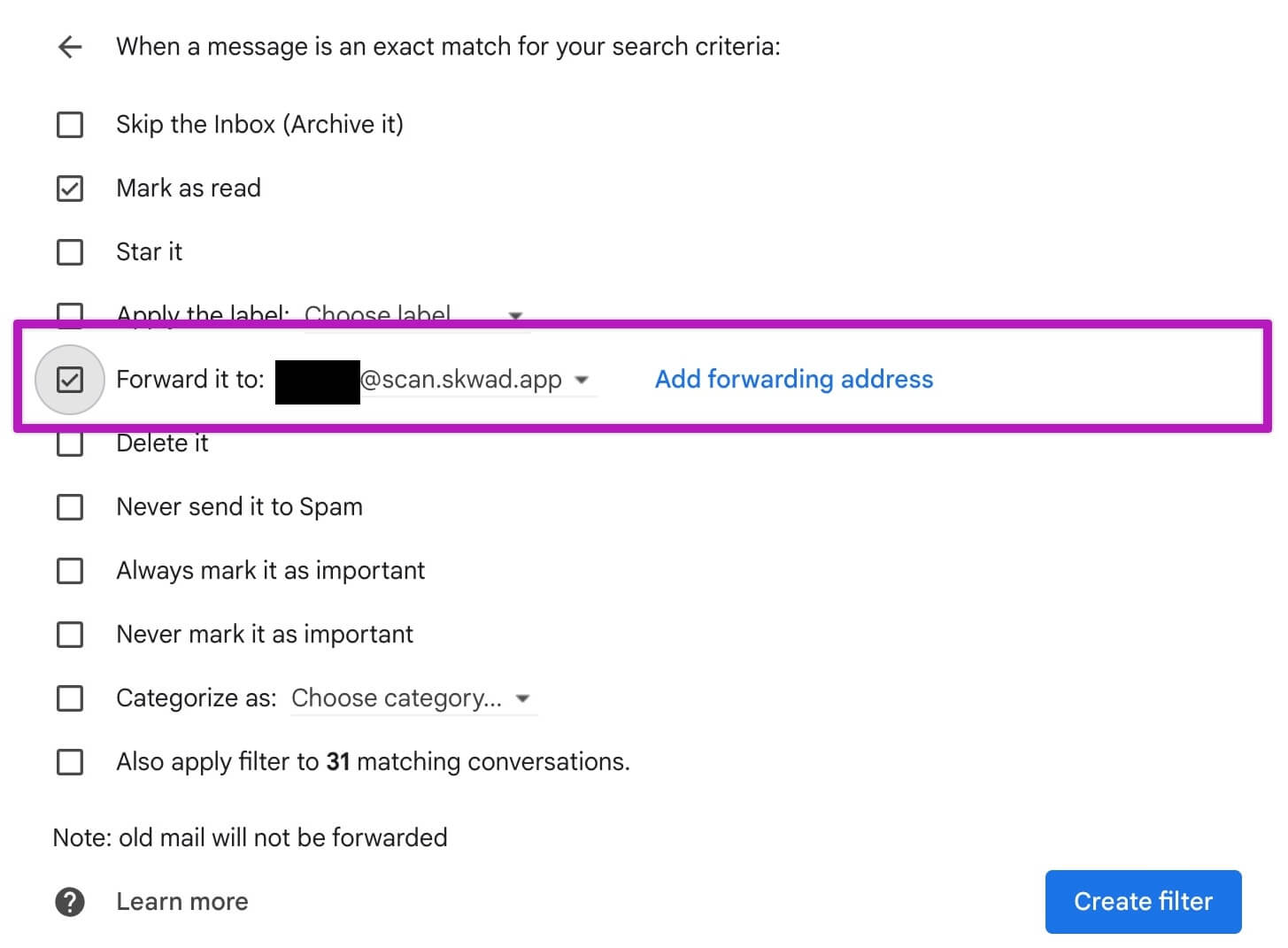

The most important checkbox is "Forward it to:". Select your Skwad scan email and check the box next to it.

Creating Custom Filters Automatically

Not sure what filter to use? Gmail can create one for you:

- Click into a transaction email you want to filter

- Click More (three dots) → Filter messages like these

- Gmail will automatically create the filter in the search box

- Copy/paste the search box content into your forwarding rule

Step 3: Skwad Does the Rest

Once you've set up email forwarding, Skwad's parsing engine starts working automatically. It reads the forwarded emails in your Skwad scan inbox, extracts all the critical transaction details like amount, merchant, and date, and categorizes them within your Skwad account.

Just like that, your finances are effortlessly tracked and organized - no manual data entry required. You can then access your consolidated transaction history and spending analytics within the Skwad app or sync to Google Sheets.

Troubleshooting

My transactions aren't showing up in Skwad

- Check if your forwarding rule is enabled

- Verify the rule conditions match your bank's email format

- Look in your Skwad scan inbox to see if emails are arriving

- Make sure your Skwad account is active with a valid payment method

I'm getting duplicate transactions

You may have overlapping rules or multiple alert types from your bank. Review your rules and turn off duplicate bank alerts. See managing duplicates.

Can I forward from multiple email accounts?

Yes! Set up forwarding rules in each email account (personal, work, etc.) to forward to the same Skwad scan address.

Privacy and Security First

We at Skwad believe privacy and security should never be compromised. Our bank-linking-free approach ensures that your sensitive financial information remains safeguarded, giving you peace of mind as you manage your finances.

Need Help?

Having trouble setting up email forwarding? Email us and we're happy to help.

Get a better understanding of your finances today.

Start your 15-day trial

More posts

- Skwad's Spend Tracking In Google Sheets

- Export Your Mint Transactions to Skwad

- Skwad Widgets for iPhone and Mac: Your Finances at a Glance

- Open Banking Budgeting: Bridging the Gap

- Optum Bank Prioritizes Customer Security, Discontinues Support for Third-Party Financial Data Aggregators

- Canadian budgeting apps that don't require Plaid

© 2026 TCS Digital, LLC.

Created and hosted in the USA 🇺🇸

Data encrypted & stored with AWS 🔒

Bootstrapped & funded by our users.

Resources

Skwad bookFree bank transaction categorizerHow to setup auto import without bank linkingBank linking with 11,000+ financial institutionsHow to auto sync transactions to Google SheetsHow to import old transactions