Signing (& Credit Cards)

Skwad signs transactions from your perspective. This means negative (-) when you spend money (DEBIT) and positive (+) when you make it (CREDIT). This is also how most budget apps sign your transactions.

Checking and savings accounts display transactions like this, but credit cards display the inverse. Money spent is positive, and your payments are negative. No worries; most credit card companies will inverse this when you export your transactions.

Trends View

- Money Out includes all your expenses (including refunds) and excludes income and transfer categories like "Transfer to Savings" or "Credit Card Payment."

- Money In includes all your income. Positive expenses like "Refunds" or "Returned Purchase" won't be included unless you explicitly mark those categories as income.

Handling Credit Cards

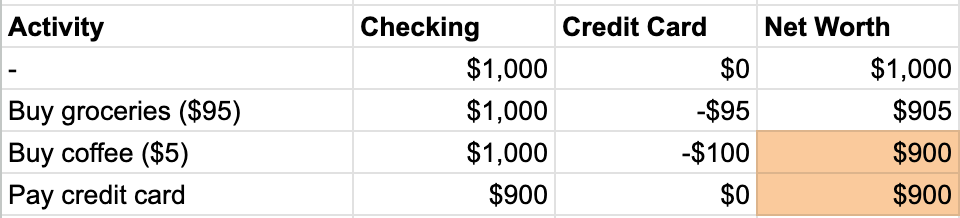

Because Skwad signs transactions from your perspective, your credit card purchases are recorded as expenses (-) when you make the purchase.

Categorizing Credit Card Payments

When you make CC payments, you typically move money from a checking (or savings) account to your credit card. Both should be categorized under the Transfer type because your net worth doesn't change. You're offseting your negative credit card balance with your positive checking account.

As far as the specific category, it depends on how granular you want it. Remember, Skwad let's you create as many categories and groups under 'Transfer', 'Expense', or 'Income'.

This is how most of us at Skwad handle our personal CC payments:

I personally categorize the money leaving my checking as "Credit Card Payment", and the money coming into my CC as a generic "Transfer" category. This way, they "zero out" under the Transfer type, but I can still see my monthly total Credit Card payments under reports.