Budget warnings

Skwad displays various warnings and notifications in your budget view to help you stay on top of your finances. Understanding these warnings helps you maintain an accurate and balanced budget.

Financial status warnings

These warnings appear at the top of your budget view and indicate the overall health of your budget allocation.

Shortfall

Appearance: Red banner

Message: "Shortfall: Expected outflows exceed income by [amount]"

What it means: Your planned expenses and transfers are greater than your actual income for the budget period. You've allocated more money than you have available.

How to resolve:

- Add more income to your budget (either actual deposits or scheduled income)

- Reduce your budget allocations in expense categories

- Use negative budget values to return money from over-funded categories back to available funds

- If you're expecting income later in the month, you can temporarily ignore this warning until your income arrives

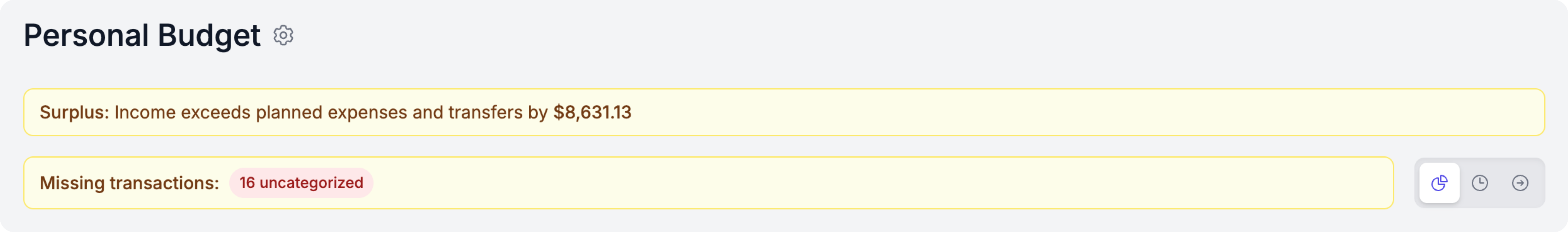

Surplus

Appearance: Yellow banner

Message: "Surplus: Income exceeds planned expenses and transfers by [amount]"

What it means: You have unallocated income. Your actual income is greater than what you've assigned to expense and transfer categories.

How to resolve:

- Allocate the surplus to existing budget categories

- Create a savings or transfer category to capture leftover funds

- Move funds to a rollover category to carry them forward to next month

- Review if you need to increase any underfunded categories

In zero-based budgeting, all income should be assigned to a purpose. Unassigned funds won't automatically roll over to the next period.

No income categories

Appearance: Blue banner

Message: "Add an income category to accurately track your budget"

What it means: Your budget doesn't have any income categories set up. Without income categories, Skwad can't calculate your available funds or show shortfall/surplus warnings.

How to resolve:

- Add an income category to your budget

- Set the category type to "Income" when configuring it

- Your income transactions will then count toward your available funds

Missing transactions warnings

These warnings appear as clickable badges that help you identify transactions that may need attention.

Uncategorized transactions

Appearance: Red badge showing count (e.g., "5 uncategorized")

What it means: You have processed transactions within the budget period that don't have a category assigned. These transactions aren't being tracked against any budget category.

How to resolve:

- Click the badge to view the uncategorized transactions

- Assign appropriate categories to each transaction

- If a category doesn't exist, create a new one and add it to your budget

Categorized but untracked

Appearance: Blue badge showing count (e.g., "3 categorized but untracked")

What it means: You have transactions with categories assigned, but those categories aren't included in your current budget. The transactions are categorized but not being tracked against any budget target.

How to resolve:

- Click the badge to view these transactions

- Either:

- Add the missing categories to your budget as new budget targets

- Re-categorize the transactions to categories that are already in your budget

- If you don't want to track these categories, no action is needed

This warning helps you identify spending categories you may have forgotten to add to your budget.

Excluded or pushed-forward

Appearance: Gray badge showing count (e.g., "2 excluded or pushed-forward")

What it means: You have transactions that are either:

- Excluded: Intentionally removed from your budget calculations

- Pushed-forward: Assigned to a future budget period (e.g., a purchase made in January that should count toward February's budget)

How to resolve:

- Click the badge to review these transactions

- If a transaction was excluded incorrectly, remove the exclusion

- If a transaction was pushed forward, verify the effective date is correct

- If the exclusions are intentional, no action is needed

Learn more about pushing transactions forward and excluding transactions.

Best practices

- Check warnings regularly: Review budget warnings at least weekly to catch issues early

- Zero out your surplus: Aim for a surplus of $0 by allocating all income

- Categorize transactions promptly: The sooner you categorize, the more accurate your budget tracking

- Use exclusions sparingly: Only exclude transactions that truly shouldn't affect your budget (refunds, transfers between accounts, etc.)

- Plan for income timing: If your income arrives mid-month, shortfall warnings early in the month are expected and can be ignored temporarily