Overview

Skwad supports envelope-style budgeting. You can budget for different categories, and track your spending against them.

Creating Your First Budget

Before creating your first budget, make sure you've read and completed our Quick Start Guide. Skwad can auto-fill your budget with accurate categories the more transactions you have imported and categorized.

Budget Categories

Before creating a budget, you need to Setup Categories to track your spending against. Your categories can be used all over the app, not just within your budget. You can even track the same categories across multiple budgets.

If this is your first time using Skwad, we highly recommend reading about How Categories Work.

After creating your categories, you can add them to your budget. Note that adding a category to your budget is different from creating a category - see our guide on adding categories to your budget for details.

After creating your categories, you can add them to your budget. You'll be asked to provide some options:

Type

- Basic: Basic categories reset every month.

- Rollover: Over/Under spent budget is added to the next month.

- Income: Income to track your spending against.

Frequency & Amount

Frequncy is how often you want to allocate the default category amount. Amount is the default budget amount for the category. You can override this amount from month to month. Set this to 0 if you're unsure.

Start date & balance

Rollover categories can have a starting balance in addition to their regular allocations. The starting balance kicks in on start date which can be on or after the budget start date.

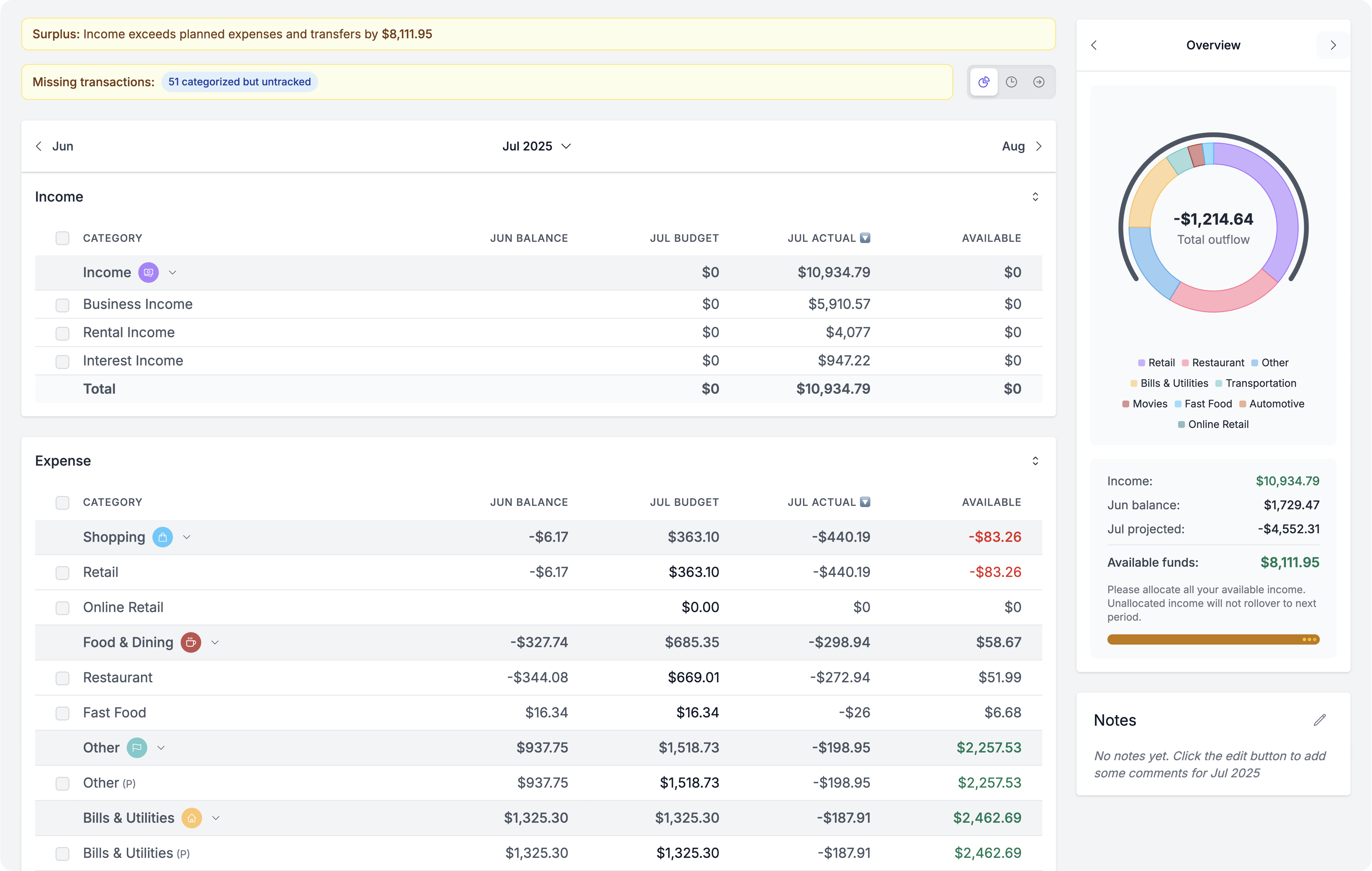

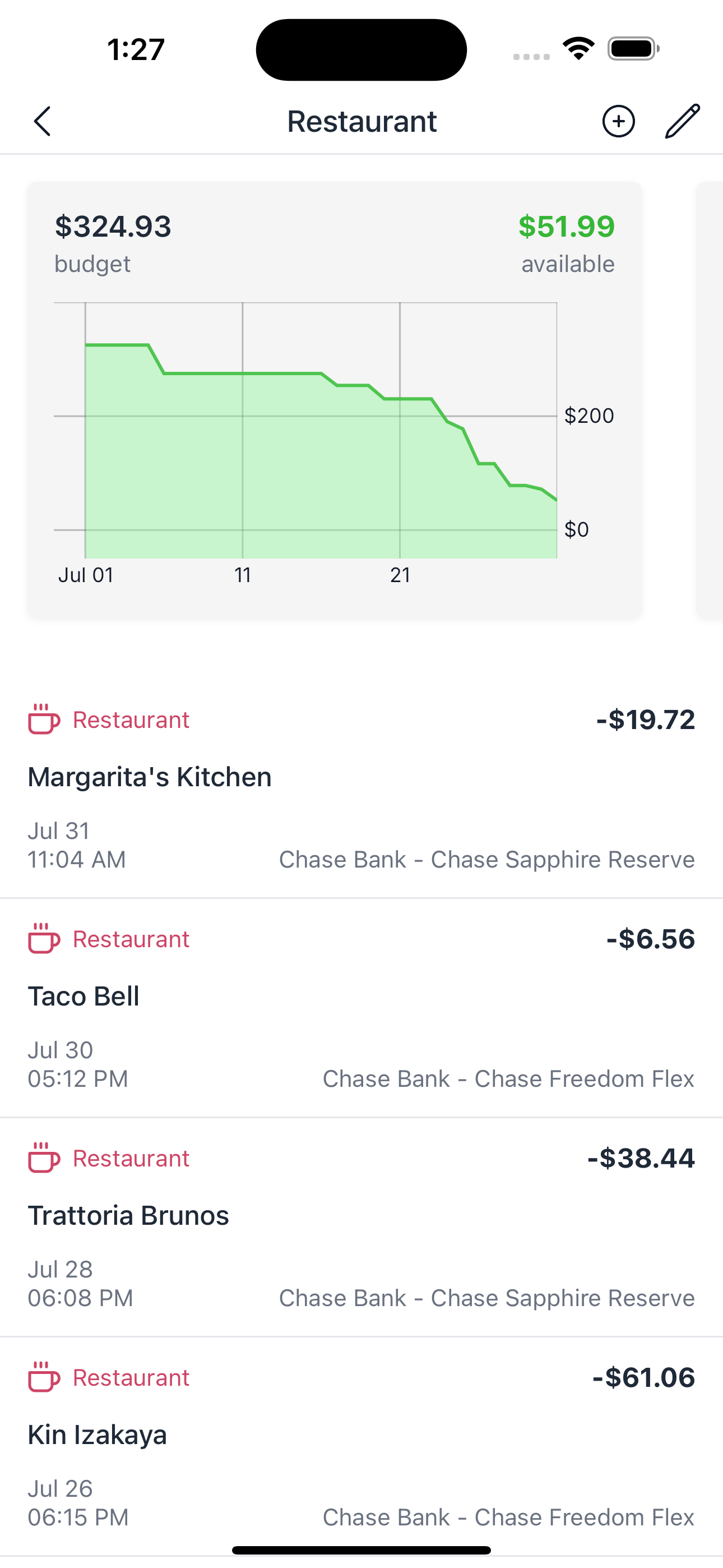

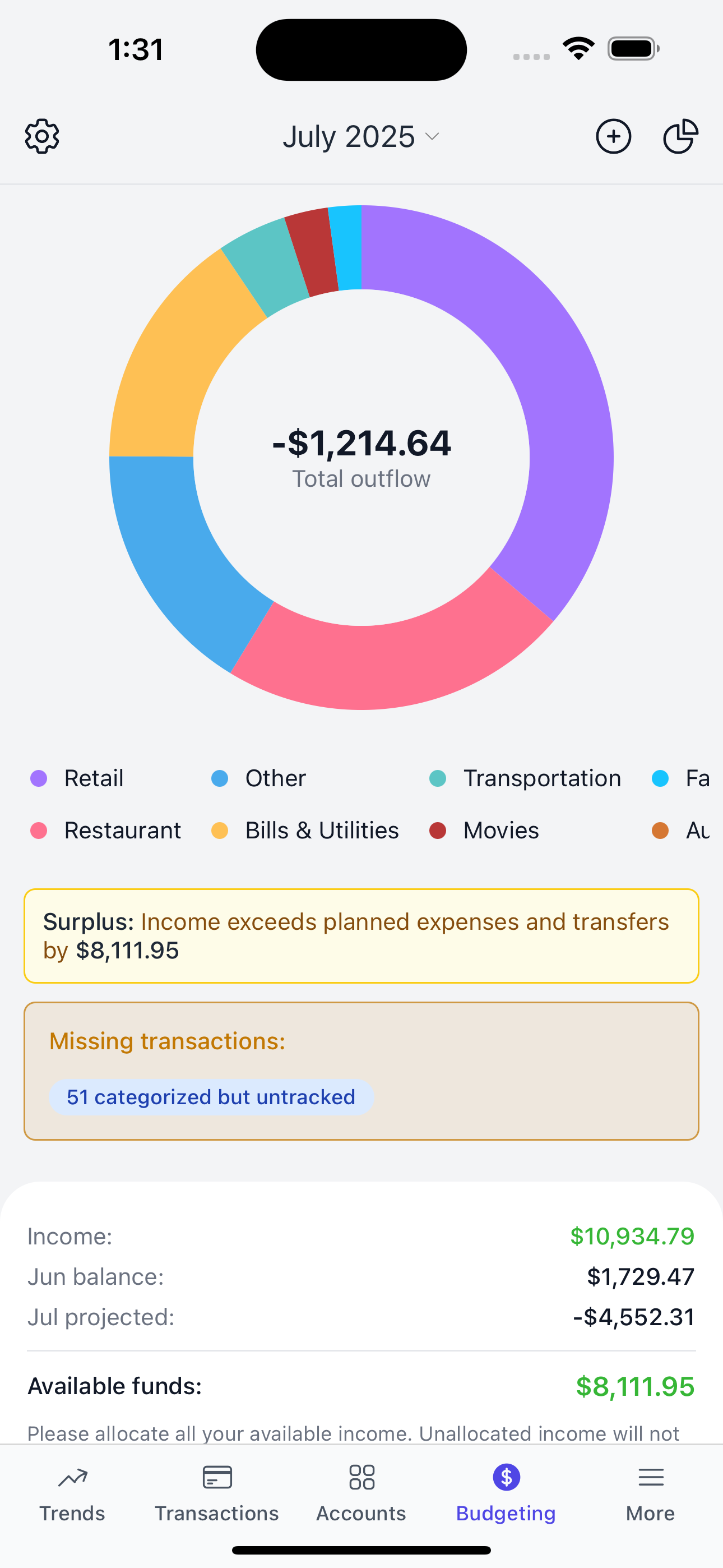

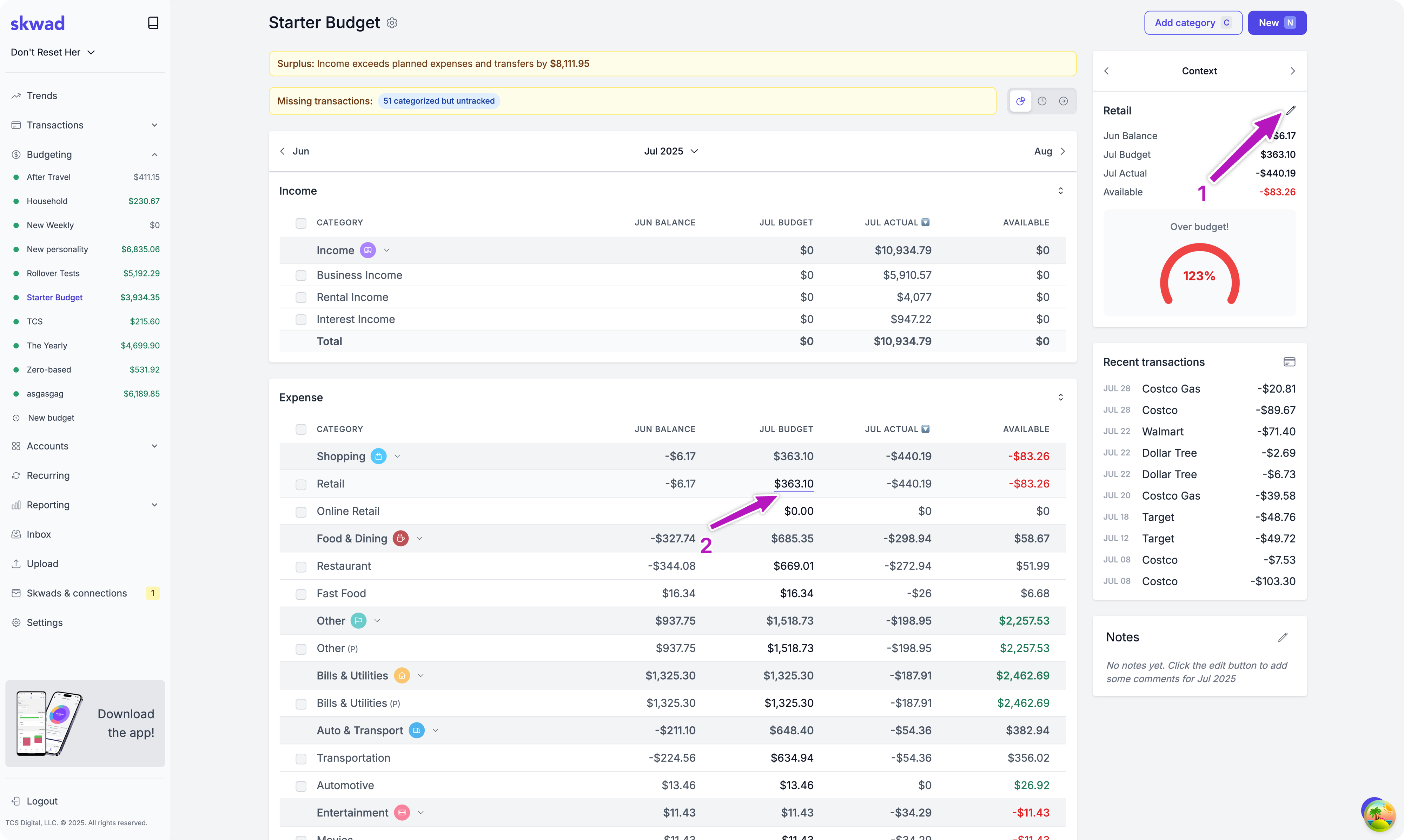

Budget View

The budget view shows you your budget and how much you have available. You'll also be able to compare your budget (or projections) to your actual spending. Skwad will also show you missing transactions that need to be categorized or that were Pushed Forward.

- When editing your budget, inline edits (2) update your budget for the current month. This overrides the default amount.

- Category edit (1) updates the default value for all previous and future months. Months with inline edits will remain the same.

Setting Your Income

Skwad's budgeting is zero-based by default. This means that you budget with money you have on-hand (actuals). If it's not on-hand (or in your bank), it doesn't exist.

You may get shortfall errors during your first month with Skwad. Feel free to ignore them if you're expecting income later in the month. The error will be removed once your income gets deposited. Over time, you'll be able to push savings towards future months to cover expenses while you wait for your income.

If you like, you could set a starting income balance for your first month, and push next month's income forward and so on...

Scheduling Consistent Income

You can schedule your income for current and future months. After adding a schedule to any of your income transactions, head over to your transaction settings and update your schedule to 3 months. Skwad will then auto-create your income for the next 3 months, allowing you to budget with future income ahead of time.

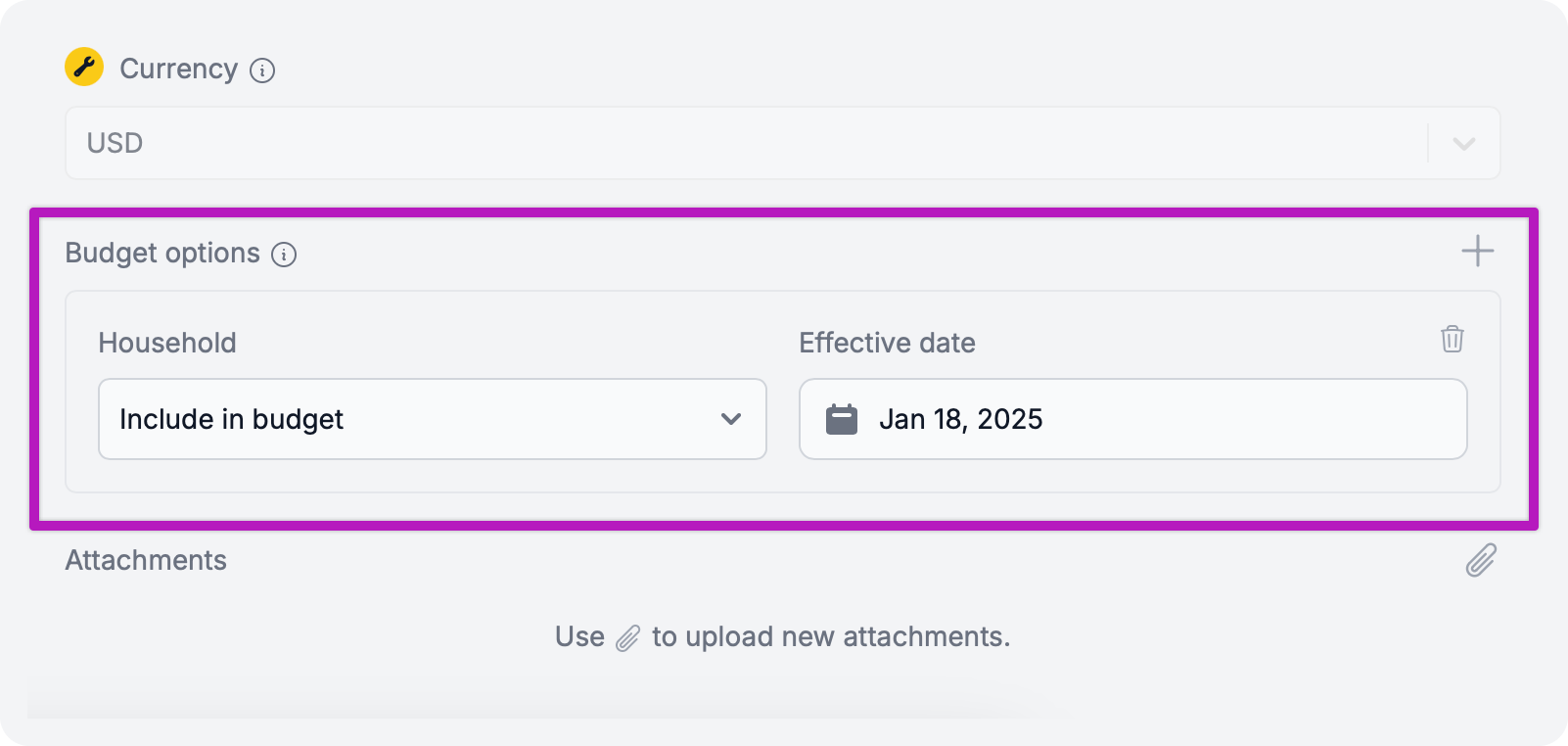

Budget Options

Budget options are optional. Transactions are automatically included in your budget as long as their categories are added to the budget. You only need to set budget options if you want to customize how individual transactions appear in your budget.

- Pushing-forward: Sometimes you buy things in advance. Set an effective budget date for when the purchase will be effective in your budget (up to 2 years in advance). This doesn't affect the actual transaction date or your trends view.

- Excluding: You can entirely exclude individual transactions from your budget. See how to exclude entire categories from your budget.

FAQs

What if I’m switching from another app mid-year?

No worries. Update your budget start date to your prefered date. Skwad will auto-fill your budget using your default amount, but you can go back and replace your budget in previous months.

Can I plan a month ahead?

Yes, you can plan a full 2-years ahead! If you're expecting a big expense next year, you can plan for it.