Managing Envelopes

Skwad uses an envelope budgeting system where your money is allocated into different "envelopes" or categories. Understanding how these envelopes work with your available funds is crucial for effective budget management.

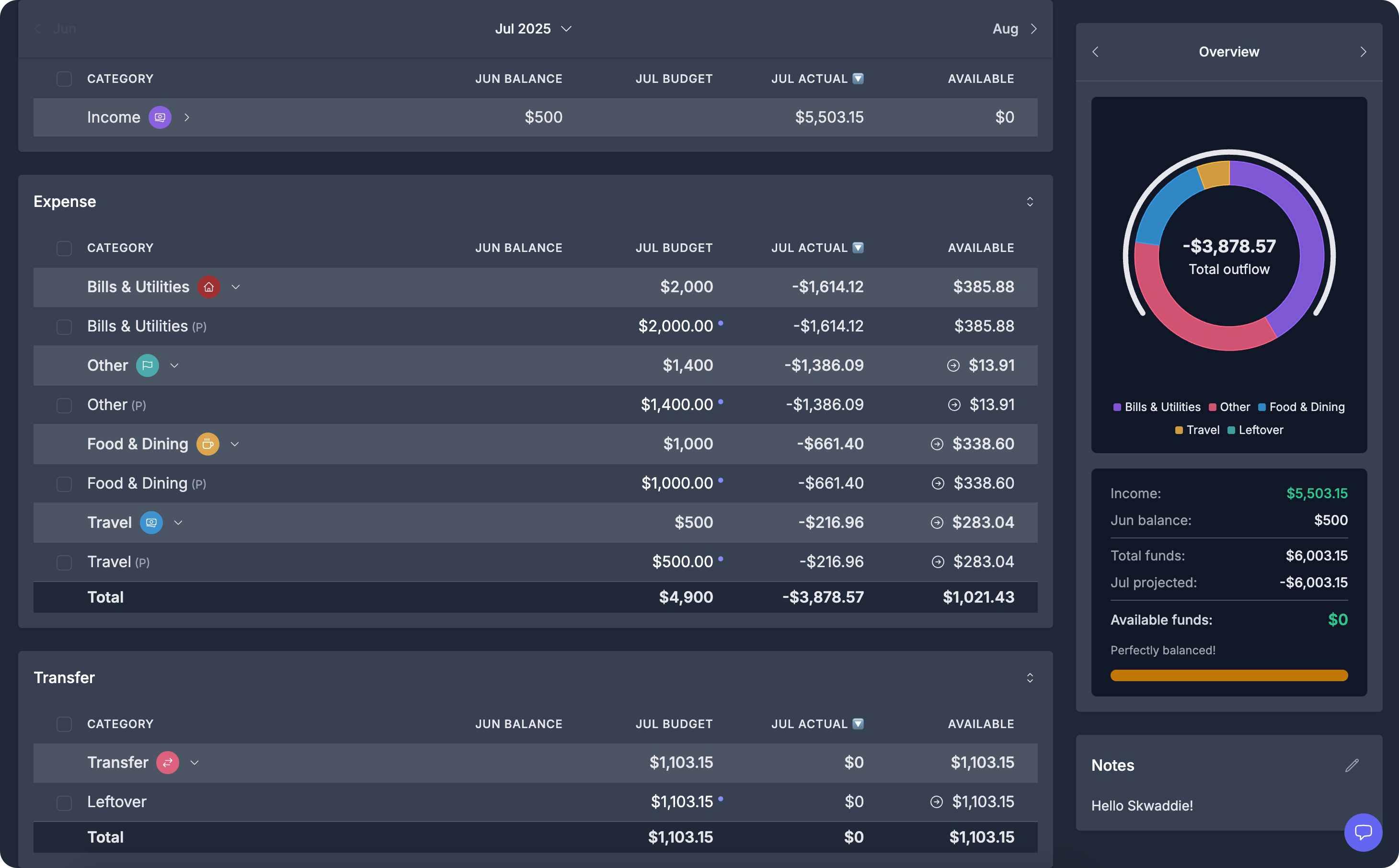

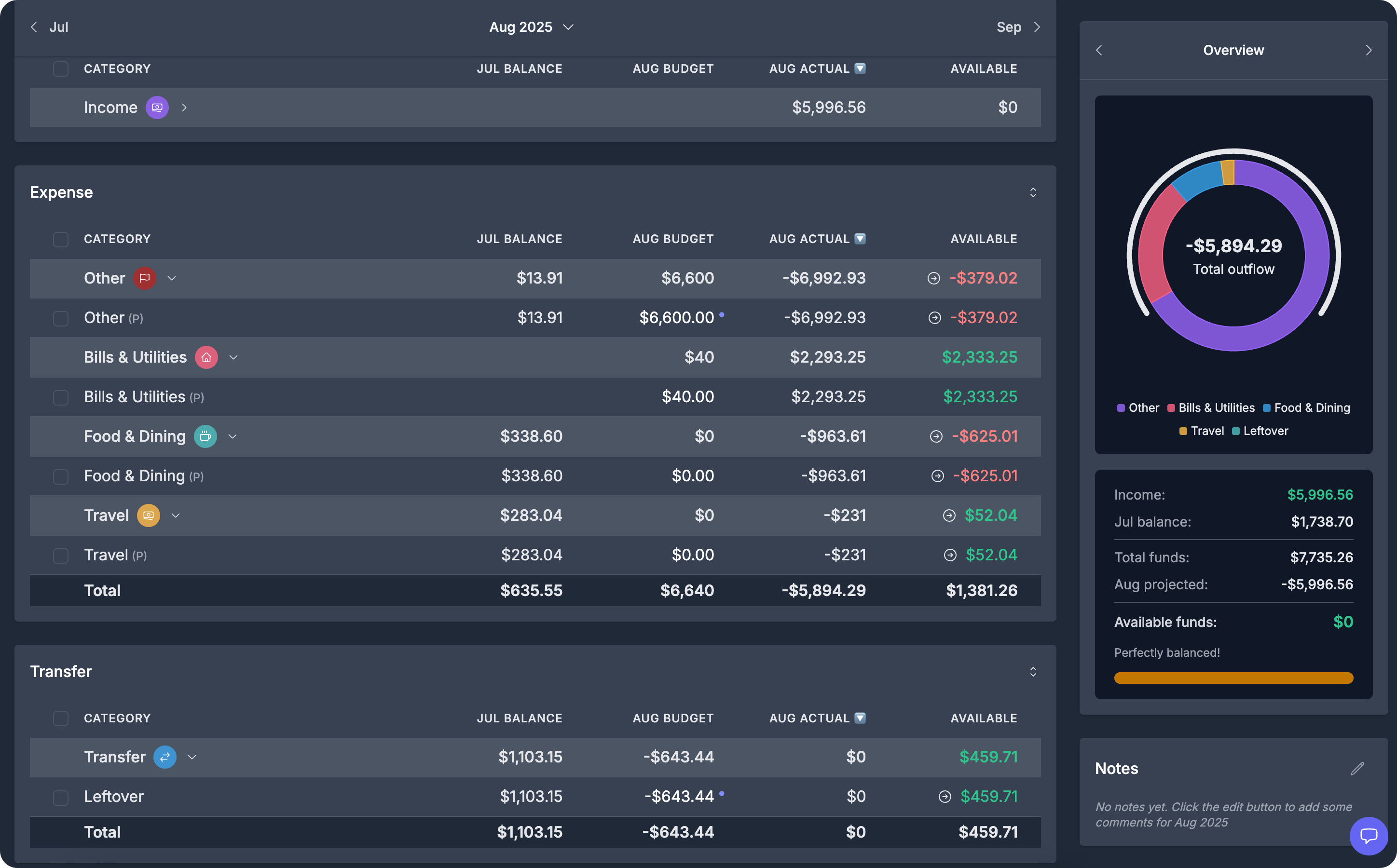

Let's run through a sample budget to see how envelopes work.

Available funds

Available funds represent the pool of money that you can allocate to your budget categories. This is the total amount of unallocated money from your income that hasn't been assigned to any envelopes yet.

Skwad will prompt you to assign all your funds and warn you if you've exceeded your available funds.

How available funds work

- Initial state: When you first create income in your budget, that income becomes available funds

- Allocation: When you assign positive budget values to expense or transfer categories, you're moving money from available funds into those envelopes

- Balance: Your available funds decrease by the amount you allocate to categories

Moving money around

Positive budget values

When you set positive budget amounts for expense and transfer categories, you're allocating money from your available funds into specific envelopes.

How positive budgets work

- Allocation: Positive budget values pull money from your available funds

- Envelope creation: Each positive budget creates a dedicated envelope with that allocated amount

- Spending tracking: As you spend against these categories, the money comes out of the respective envelopes

- Available funds reduction: Your available funds decrease by the total of all positive budget allocations

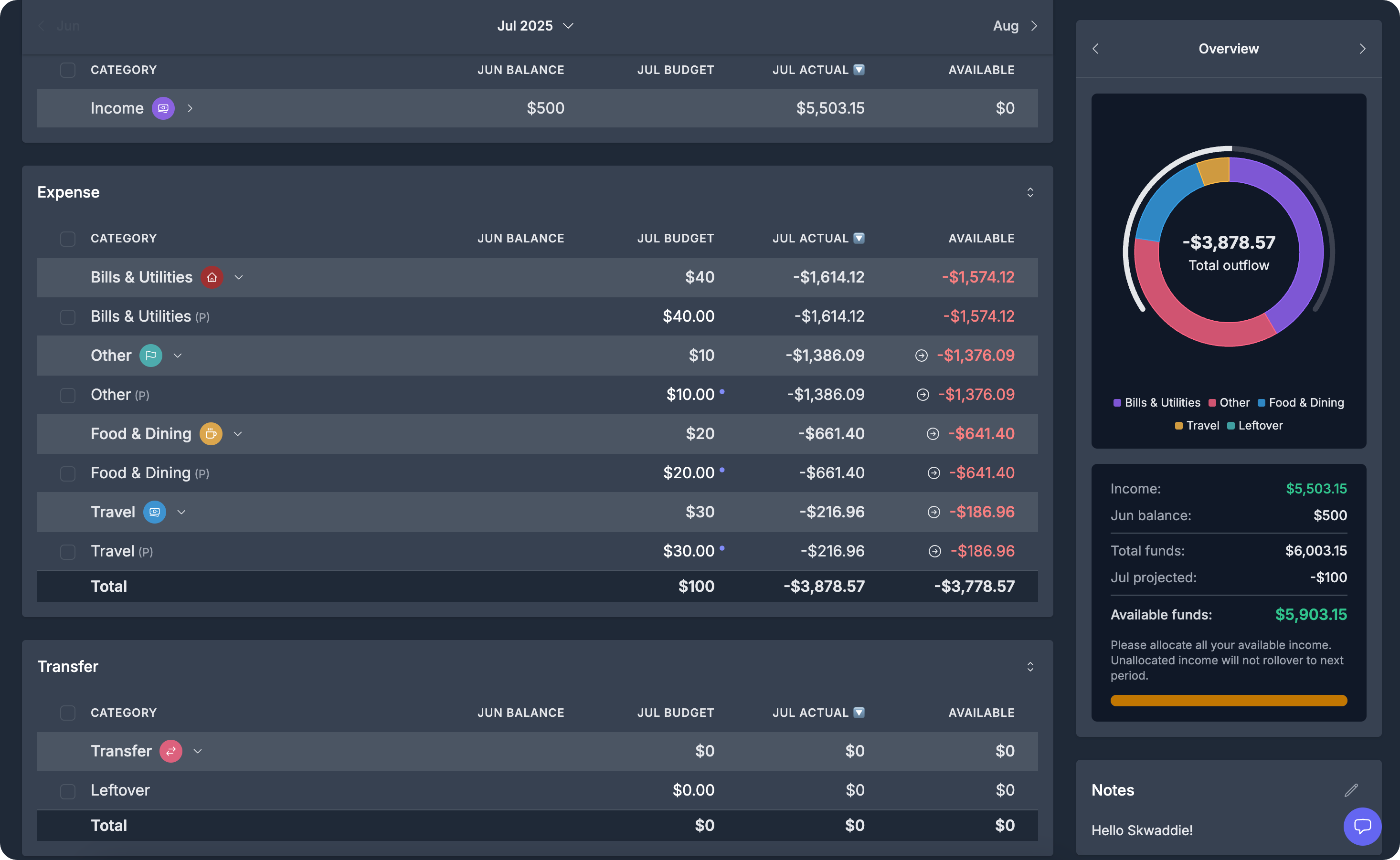

Example workflow

In our example, we've moved funds from the available bucket to fund each of our categories. You'll notice that even after overfunding our categories, we still had $1,103.15 left. We've assigned that to a left over transfer category for next month.

All income must be assigned to a bucket. Unassigned funds won't rollover.

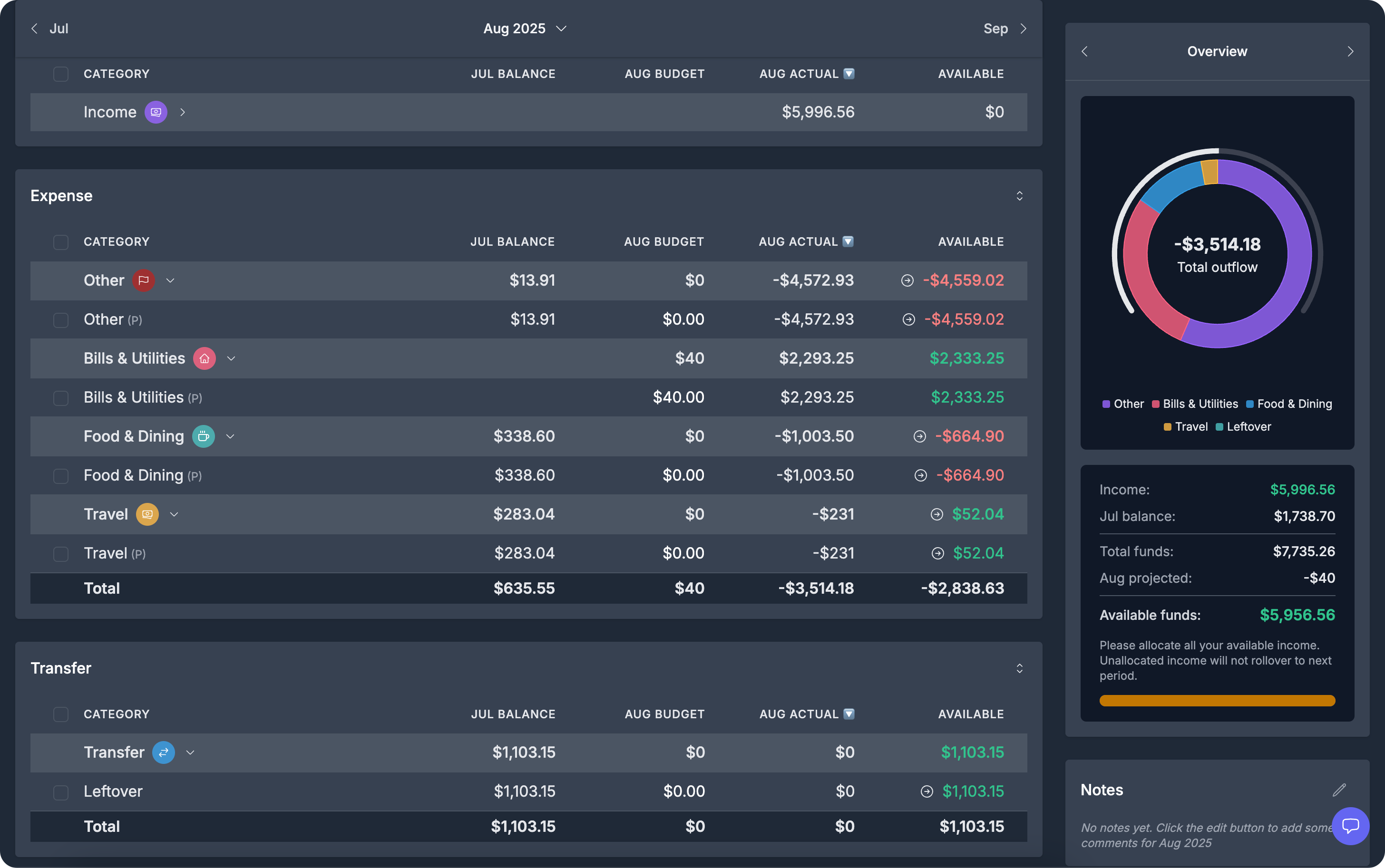

The following month

You can see that all our balance (including our leftover) carried over from last month. Note: Only rollover categories behave this way. Basic categories will not carryover.

But now we have a new problem. We have a massive unexpected expense in Other and a big Food & Dining bill to cover.

Even after assigning everything we earned this month, we still need more. We've used up more than our available funds!

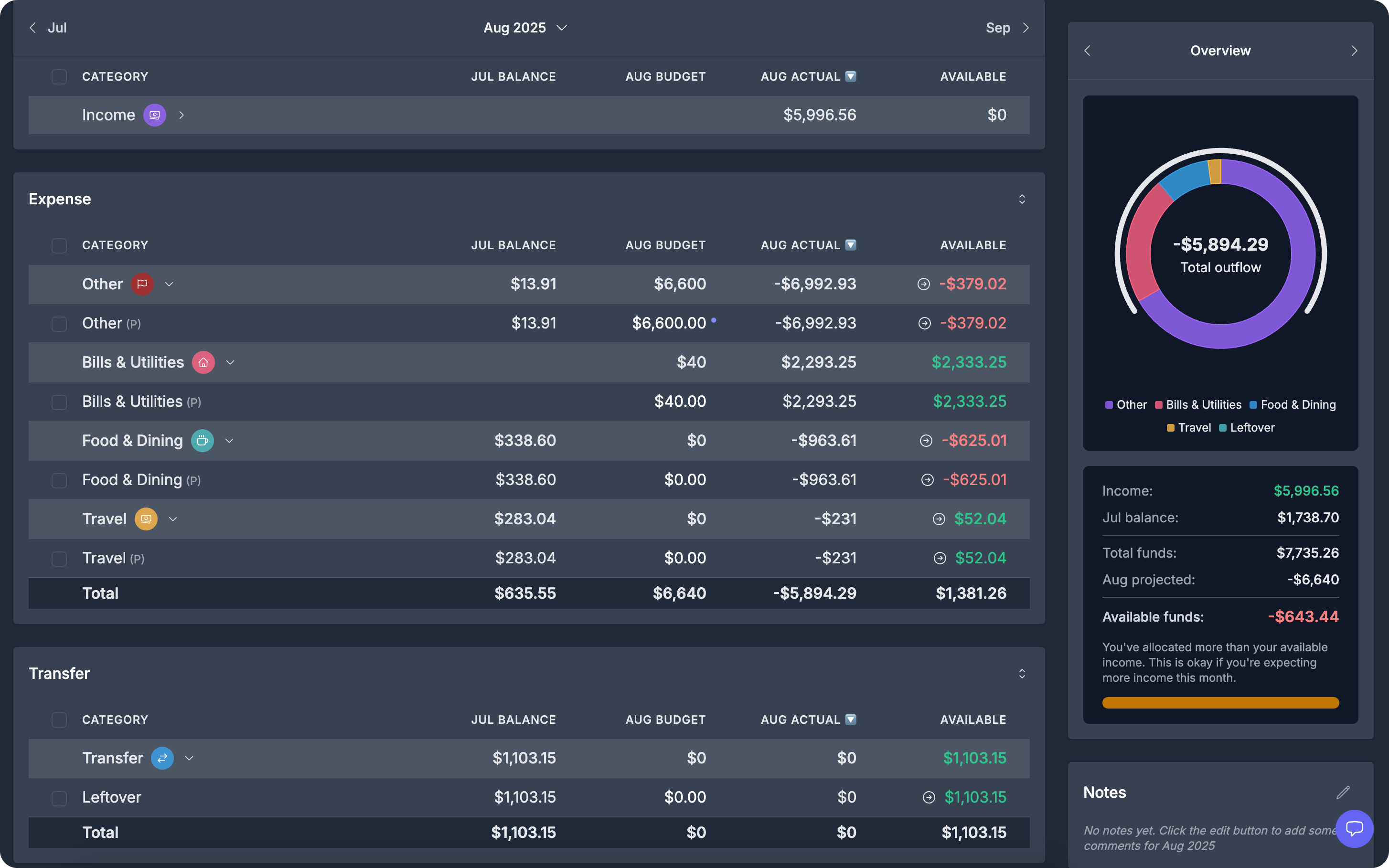

Negative budget returns

Negative budget values work in reverse - they return money back to your available funds pool. This is particularly useful for:

- Corrections: When you over-allocated to a category and need to free up funds

- Flexible planning: Moving money between categories by using negative values

- Income adjustments: Accounting for irregular income or windfalls

How negative budgets work

- Return funds: Negative budget values add money back to your available funds

- Envelope reduction: The category's envelope is reduced (or becomes negative if it creates a deficit)

- Available funds increase: Your available funds increase by the negative budget amount

Example workflow

Our leftover bucket can easily cover the excess spending using the funds we saved last month!

Best practices

Planning your envelopes

- Start with essentials: Allocate positive budgets to must-have categories first (rent, groceries, utilities)

- Use available funds as buffer: Keep some available funds unallocated as an emergency buffer

- Regular reviews: Check your envelope balances monthly and adjust with positive/negative budgets as needed

- It's okay: Expecting your income later in the month? It's okay to plan today, and match your projections when your deposits land in your bank account.

Managing cash flow

- Positive budgets when you want to commit money to a specific purpose

- Negative budgets when you need to free up funds for reallocation

- Monitor available funds to ensure you don't over-commit your income